What happens after fixing the Federal Interest Rates

06.10.2023

What happens after fixing the Federal Interest Rates

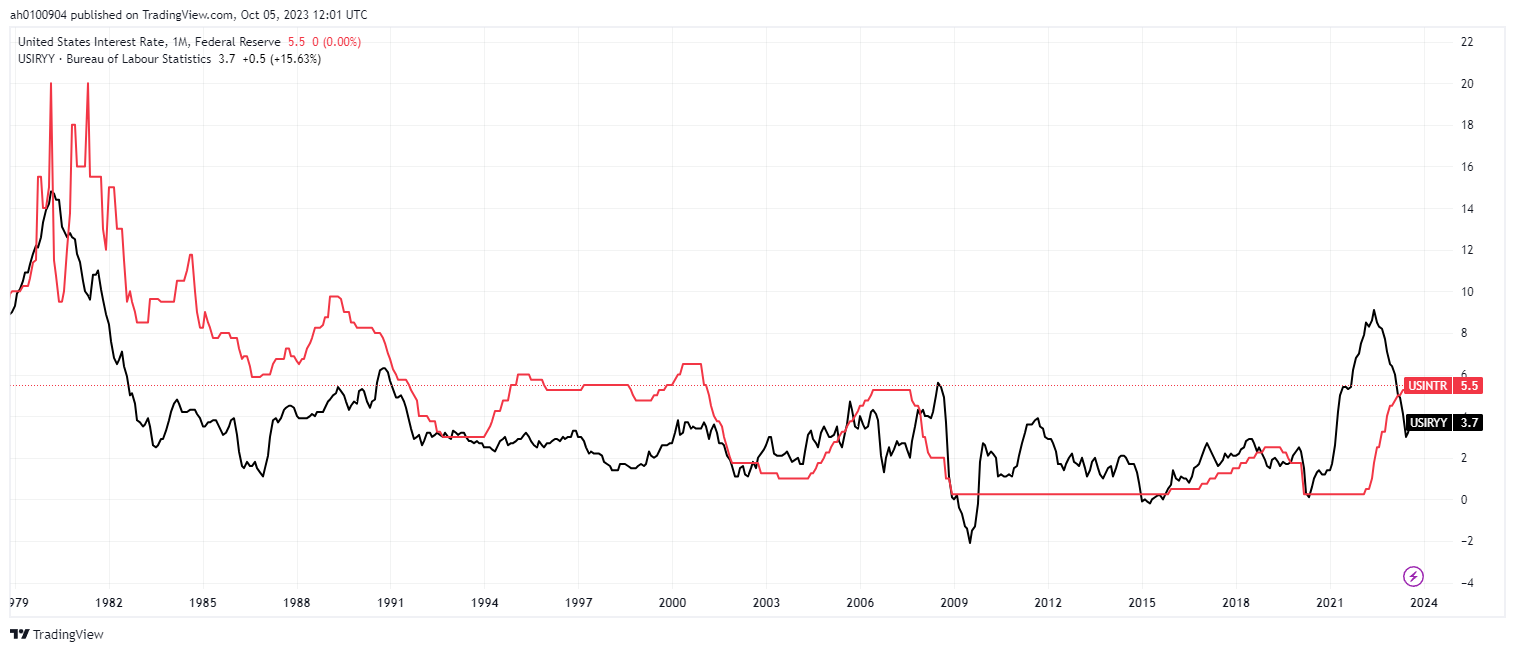

In the last meeting, which was in September 2023, the US Federal fixed the interest rates for the second time in a row after it began to raise interest rates since the beginning of 2021 to 5.5% to control the rise in inflation rates, which reached 9.1% on an annual basis in May 2022, which is the highest inflation level since 1981, and inflation rates began to decline, reaching 3.7% on an annual basis, in the July 2023 reading. After it had fallen to 3% in the May 2023 reading, and despite the low inflation rates, it is still above the bank's target of 2%. The following chart shows the movements of inflation and interest rates with the red line expressing interest rates and the black line crossing inflation rates.

This affected the performance of US indices, as the S&P index fell at the beginning of 2021 until it reached the level of 3480 in October 2022, after it reached its highest level at the level of 4800, with a decrease rate of 25%, and looking at the following chart, which shows the movements of the index on the weekly time frame, and in light of the continued rise in interest rates, we note that it is still expected that the decline will continue, which may target the level of 3760.

Federal Reserve Governor Jerome Powell has stated that the US Federal Reserve is ready to raise interest rates further if necessary, and with the rise in energy prices, this may lead to high inflation rates again, which may force the Fed to raise interest rates by 25 basis points, however, this may reflect positively on the US dollar currency against other currencies as stocks .continue to fall.